Loose monetary policies have caused a surge in commodities and stock markets around the world. Part of the surge in gold prices have been attributed to the weakness of US dollar where investors dump US dollars in the expectation that inflation will raise and Gold will better preserve value.

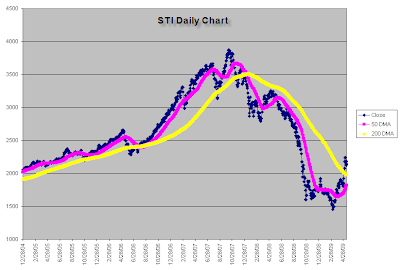

The phase chart is still in bullish phase. However, warning signs are appearing. The price dropped below its 50 day moving average on Thursday briefly dipping to “Warning” phase. It is still early to talk about a trend reversal at this stage but the price behavior warrants some caution as a drop below its 50 day moving average is a sign that investors may start to take some profits off the table.